08 Oct PDF Factors affecting Gold prices: a case study of India Sandeep Anand

This could dilute the sharp division in consuming and investing habits between rural and urban consumers in the coming years. Taken together, they could engender a period of sustained recovery for the rural economy, driving GDP growth and consumer spending across India. There could also be considerable consequences for India’s gold industry, as rural households still account for a majority of India’s gold demand. Sustained growth in rural incomes may therefore foster demand for gold. The most precious metals is Gold for long and its

value has been used as the standard for many currencies also known as gold

standard.

Weekly Musings – Macro Quartet for the week ending August 04, 2023 – Indiainfoline

Weekly Musings – Macro Quartet for the week ending August 04, 2023.

Posted: Sat, 05 Aug 2023 00:23:00 GMT [source]

Moreover, there exists a strong correlation between the value of the gold and the strength of currencies trading on foreign exchanges. You can purchase gold in India through jewellers, banks, etc. The gold rates in India are affected by factors like inflation, fluctuations in gold prices globally and the Central Gold Reserve.

One of the significant factors is the gold reserve held by the Reserve Bank of India (RBI). However, other factors influence the gold rate of 22K in India. This ensures the price of gold does not fall as steeply as the price of other market instruments and remains fairly stable or even rises. Investment in digital gold can be profitable depending on when you sell your gold. The benefit of investing in digital gold is the ease with which the investment can be made via a digital platform. One doesn’t need to track gold prices with jewelers or bullion trades.

A framework for investment growth

At times the availability of gold depends upon the controllers of this jewellery market. If the availability of gold is less in the jewellery market, the price will elevate and vice versa. Generally, the availability depends upon the guidelines given by the government. Gold demand and interest rates on financial goods and services are inversely related. In general, the price of gold at any given time is a reliable indicator of a nation’s interest rate developments.

- In general, the inflation rate and fluctuations in the price of gold tend to be inversely correlated.

- Meanwhile, application of new mining techniques,

discovery of new gold ores and sales of gold by central banks will exert

impacts on gold price. - The price of Gold has also been affected by the European Union recovery package.

- The causal relationship between gold prices and stock index (S & P CNXNIFTY) of NSE of India was studied [16] .

- All of these factors work together to drive up domestic gold demand to the point that India frequently has to import significant amounts of this precious metal.

Le and Chang [22] examined the association between gold price and crude oil price based on monthly time series data from 1986 to 2011 and showed that both the variables are closely linked with each other. In 2012, Dr. Ira Bapna looked at how changes in macroeconomic factors affect the gold price. The purpose of the research was to investigate the link between GDP, the exchange rate, stock returns, inflation, and the interest rate and gold price. Gold does not influence the exchange rate, BSE Sensex, NSE Index, foreign reserves, or fiscal deficit, but it does influence the interest rate and inflation, and vice versa.

Ways To Buy Gold In India

This is one of the key reasons why gold is considered extremely valuable around the world. In India, it holds cultural and religious importance as well and therefore, is a part of most Indian weddings and ceremonies. All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Gold Rate Update: Prices of precious metals move up North, check current rates in your city – DNP INDIA

Gold Rate Update: Prices of precious metals move up North, check current rates in your city.

Posted: Wed, 26 Jul 2023 07:00:00 GMT [source]

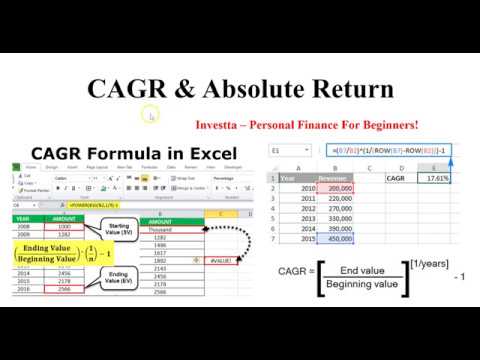

Gold has been used throughout history as money and has been a relative standard for currency equivalents specific to economic regions or countries, until recent times. The statistical package SAS was used to get the Predictive model of the changes in the prices of gold using multiple linear regression). As early as the Byzantine Empire, gold was used to support fiat currencies, or the various currencies considered legal tender in their nation of origin.

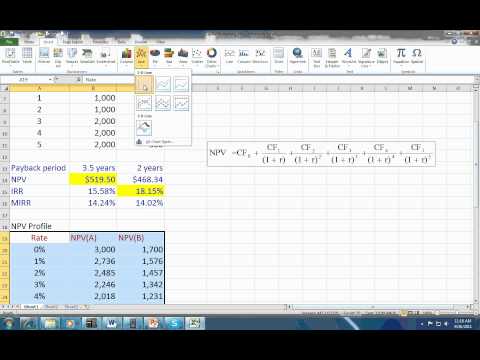

The impact of domestic gold price on stock price indices-An empirical study of Indian stock exchanges. Universal Journal of Marketing and Business Research, 2(2), 35-43. Analysis shows that growth rate and GDP affect gold prices, and gold prices affect growth rate and GDP. It has been shown that the coefficient of correlation between Sensex and gold prices is 0.703, the rate at which gold prices are traded is 0.196, and the inflation rate is 0.183. • To explore the connection among macroeconomic factors and gold prices.

Government policies and the impact on gold

The international market also affects the gold rate of 22K in Mumbai and other cities of India. The International gold market tends to be affected by various factors, including the dollar index, the strength of gold prices, and the interest rate. India’s gold rate of 22k has reached almost 50,000 rupees per ten grams 22k category.

The goal of this article is to investigate the causal relationship between gold and macroeconomic variables. It states that it does not influence or affect the exchange rate, the BSE Sensex, the NSE Index, foreign reserves, or the budget deficit, but it does affect interest rates and inflation, and vice versa. GDP and growth rate have a bidirectional relationship in terms of gold pricing.

A changing environment for gold as an investment

Exchange rates, fiscal deficits, and forex reserve inflation rates all have a big effect on gold prices, but growth rates, GDP, the bourses, and the index don’t have much of an effect. Mostly gold is considered as an absolute substitution for appreciating the currency gold price depends on which factors in india of a country. Though there is relationship between gold prices and the value of fiat currency the inverse is not always true. That is if demand for the production of gold is high, the gold prices will increase but the local currency may be very high at the same time.

The value of currency increases when a country is an exporter. More specifically a country that exports gold reserves will witness an increase in the strength of its currency. In other words, an increase in the price of gold can generate a trade surplus. The supply and demand of the domestic currency depends on the purchase of gold by Central bank and this many lead to inflation. This happens because banks rely on printing more money to buy gold, thereby creating an excess supply of the fiat currency [9] . The NIFTY and BSE Sensex (stock indices) have an effect on gold prices, although it is minor due to data multicollinearity Srinivasan & Prakasam (2015).

The rate of interest in these products is inversely related to the price of gold due to a negative correlation. As interest rates on these products increase, gold rates go down. Indian economy keeps fluctuating, and Inflation in India is quite a long-going phase. In the present condition of inflation, the worth of Indian Rupee might experience a sharp depreciation in comparison to international currencies like USD. Thus, more people will look forward to purchasing gold resulting in its high demand in the market.

The investors sell gold during this time and incur a decent profit. In India, gold bullions are not accepted by the loan providers. Thereby, gold prices are highly dependent on factors like global conditions and international relations. Several electronic firms use the metal in small amounts to make products like televisions, computers, GPS units, etc. Gold is used in India for jewellery needs, as a gift item, as a status symbol, and as a reliable hedge against growing inflation.

Factor #2: Inflation

However, the Crude Oil Price and the Nifty Index have positive beta coefficients. This elucidates that as the NIFTY and the crude oil price increase the value of the gold also increases. Sujit [25] studied the relationship between Gold price, stock returns, Exchange rate and Oil price.

Keen to redress the situation, the government announced a series of measures in 2016, designed to double farmers’ income by 2022. Three specific laws were introduced last year to help farmers still further and policies have been launched to boost non-farming rural incomes too (see Appendix 2 in the full report). Gold plays the most outstanding contribution to Indian economic health. Let’s glance at how gold affects financial health in different ways. Gold manufacturing, Gold Refining, Gold loan investment, Gold Exports, and Gold Imports are some key areas that contribute immense value to the Gold Economy in India. The data were collected from a range of secondary resources.

It was found that there exists long-run cointegration among all variables in each country except for UST. The findings supported that there exist bidirectional relationship between crude oil, gold and Taiwan stock market. Similar variables were considered for Indian context also and found that there is long-run cointegration among all variables under study [15] . The findings of this research have several implications especially in terms of portfolio diversification.

- The gold rate of 22k in Chennai is also based on changes in US dollars.

- ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced.

- When gold prices rise, if interest rates are good, people prefer to invest in fixed return investments.

- One doesn’t need to track gold prices with jewelers or bullion trades.

- Sustained growth in rural incomes may therefore foster demand for gold.

Click the following link to read our guide on how to buy sovereign gold bond. When you sell this gold jewelry, you may not be able to retrieve the making charges and the GST paid at the time of purchase. When the relationship between two countries is affected, it could halt or negatively impact the smoother import and export of gold. If there is a lesser supply of gold, gold prices may decrease. If you are planning to buy gold in India, it is crucial to understand the current prices first.

Sorry, the comment form is closed at this time.